5G spectrum landscape in South America

August 18, 2020

5G networks are being deployed more rapidly than previous generations of mobile technology. As at August 2020, more than 80 commercial 5G networks have already been deployed around the world, and this number is expected to increase to more than 200 by the end of 2020.

Regulators around the world have been developing their 5G spectrum plans with a special focus on new mobile bands identified for providing 5G services, such as the 3.5GHz band which has been assigned in several countries. Worldwide, more than 40 countries have completed allocations of 5G suitable spectrum and more than 50 have plans for allocating 5G spectrum before 2022.

It is predicted that by the end of 2025 5G subscriptions will account for around 30% of all mobile subscriptions globally. For Latin America a much slower 5G adoption is expected, with 5G set to comprise only 13% of mobile subscriptions in the region by the end of 2025.

Although 5G adoption in South America is expected to scale up later than in other regions of the world, consultations for future spectrum auctions are underway and some countries already announced auctions for 5G spectrum.

Uruguay and Brazil – first 5G networks in South America

While operators from several countries in the region have been pilot testing 5G technology, as at August 2020 only two countries have 5G services commercially available. The region’s first 5G network was deployed in April 2019 by Uruguay’s state-owned operator (Antel). Coverage of the network, which uses the 28GHz band, is restricted to specific areas within the country however, it is expected to increase over 2020-2021.

Mobile network operators (MNOs) in Brazil are launching 5G services using Dynamic Spectrum Sharing (DSS), a technology which allows 5G deployment re-using spectrum currently used by other technologies such as 4G or 3G. Since July 2020, Claro started offering 5G services in limited areas of the two most populated cities in the country, Sao Paulo and Rio de Janeiro. Claro’s 5G network re-uses the spectrum currently used by the carrier to support LTE-A services – the 700MHz, 1800MHz and 2.5GHz bands. Vivo announced that it will start offering 5G services from the end of July 2020 in certain areas of eight cities including Sao Paulo, Rio de Janeiro and Brasilia. TIM Brasil (the Brazilian subsidiary of Telecom Italia) announced that 5G commercial services will be available in three smaller cities, later in September 2020. Both TIM Brasil and Vivo will also be using DSS.

Spectrum plans for 5G in South America

Regulators and operators in South America are working towards the deployment of 5G infrastructure and services, and access to spectrum is a key enabler. Service availability, the extent of coverage and the quality of the 5G services will depend on timely access to the right amount and type of spectrum. Most of the countries in South America conducted public consultation processes on the use of spectrum for 5G and, in some cases, announced plans for spectrum auctions.

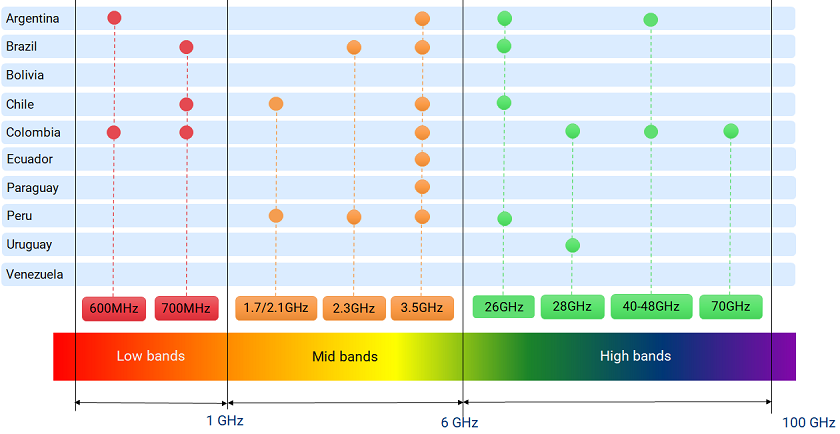

Exhibit 1: 5G spectrum – bands for consideration among South American countries [Source: regulators]

Following international trends, countries in South America are also prioritising the 3.5GHz band. Most of the countries in the region included the 3.5GHz band within their spectrum plans (Exhibit 1) and will be allocating this spectrum between 2020 to 2021. Spectrum at 3.5GHz provides a good balance between coverage and capacity and as such is being used for the first implementations of 5G around the world.

In addition to mid bands, 5G networks will also require mmWave spectrum for providing higher capacity and spectrum frequencies below 1GHz for greater coverage. Within the mmWave range 26GHz and 28GHz are the bands selected by most South American countries. Colombia and Argentina are also considering bands in the 40GHz to 48GHz range. 600MHz and 700MHz are the low frequencies being considered for coverage by countries that identified spectrum in this range (Exhibit 1).

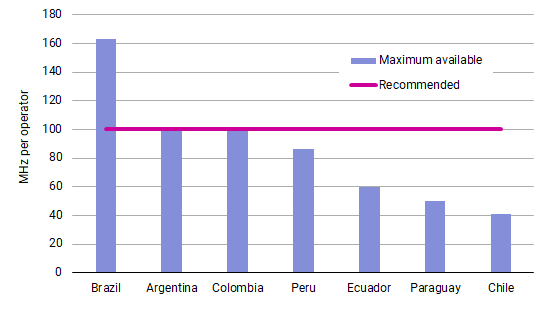

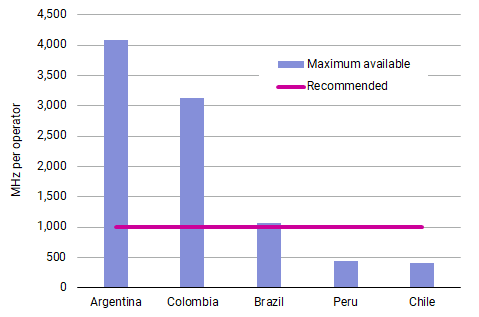

ITU’s minimum spectrum requirements to meet 5G technical specifications are at least 100MHz channels per operator, and up to 1GHz per operator in high bands. The GSMA recommends that regulators make available between 80-100MHz of contiguous spectrum per operator in mid frequencies (such as 3.5GHz), and around 1GHz per operator in high bands (for example mmWave).

Of the countries which published spectrum plans, only three countries (Argentina, Brazil, and Colombia) identified enough spectrum to satisfy the GSMA-recommended amount per operator (Exhibit 2 and Exhibit 3). Reallocation of spectrum currently used by other technologies would be needed to complete the gap for the other countries.

Exhibit 2: 5G spectrum per operator – mid frequencies [Source: Network Strategies]

Exhibit 3: 5G spectrum per operator – high frequencies [Source: Network Strategies]

Spectrum allocation – a key enabler for mobile services

Timely release of sufficient bandwidth will speed up 5G deployment, improve 5G network performance and quality of services, cut down deployment costs and bring economic benefits.

In terms of the amount of spectrum allocated in the region for mobile services, South America is already lagging ITU’s recommendation for 2020 (1,340MHz when assuming lower user density and 1,960MHz for a higher user density). By May 2020, the average spectrum allocated in the region was only 32% of the ITU recommendation for a lower user density. The two countries that allocated more spectrum were Brazil and Peru, with 45% and 41% of the ITU recommendation, respectively. The rest of the countries were below the 40% mark.

This situation could improve in the coming years if more spectrum is made available. Providing better and new mobile services, such as 5G, depends strongly on operators’ investments and the allocation of radio spectrum by governments and regulators. Both factors will be key for the success of 5G and as such, cooperation between both parties and other industry players will be crucial to put in place spectrum plans which foster efficient 5G deployments and maximise socio-economic benefits.

Spectrum plans by country as at August 2020

Brazil’s regulator Anatel plans to auction spectrum in the 700MHz, 2.3GHz, 3.5GHz and 26GHz bands. The auction was originally scheduled for 2020 but has been delayed until 2021 due to the COVID-19 pandemic. At the beginning of 2020 Chile’s regulator (SUBTEL) launched a public consultation seeking comments on the planned 5G spectrum allocation. A total of 20MHz in the 700MHz band, 30MHz in the 1700/2100MHz, 150MHz in the 3.5GHz, and 800MHz in the 26GHz band is expected to be allocated during Q4 2020. After undertaking a public consultation, in December 2019 Colombia’s Ministry of Information Technologies and Communications (MinTIC) published an action plan for the deployment of 5G. Frequencies identified as candidates for the deployment of 5G services are 600MHz and 700MHz, mid-frequency bands between 3.3GHz to 3.7GHz, and mmWave bands including 28GHz. The plan establishes the award of 3.5GHz frequencies by 2021 and the assignment of frequencies for the development of 5G test pilots. In April 2020 a total of five companies, including two MNOs and one Mobile Virtual Network Operator (MVNO) were granted temporary permits to use 3.5GHz spectrum for 5G trials. Ecuador’s Ministry of Telecommunications released a digital roadmap which includes the deployment of 5G services in 2021-2022, and anticipating plans to allocate 3.5GHz spectrum in 2020. The Ministry of Transport and Communications of Peru (MTC), identified a total of 500MHz in the 3.5GHz band for 5G services (of which at least 200MHz is planning to be auctioned) and a total of 1,300MHz in the 26GHz band. There is also a planned auction for the second half of 2020, of spectrum in the 1700/2100MHz and 2.3GHz bands to support the deployment of 4G and 5G technologies. In Paraguay, the regulator (CONATEL) published in January 2019 a resolution which assigns the 3.5GHz band for the provision of mobile services however later announced that spectrum frequencies for the development of 5G networks will not be auctioned before 2024. In Uruguay 5G services are being provided by Antel using the 28GHz band. No other announcements have been made in regards to plans for 5G spectrum. Venezuela and Bolivia have not made any announcements about their plans for 5G spectrum. Bolivia’s stated-backed operator (Entel) tested 5G technology in 2019. In January 2020 the Venezuelan regulator announced that it had started working together with country's operators on developing 5G trials. |